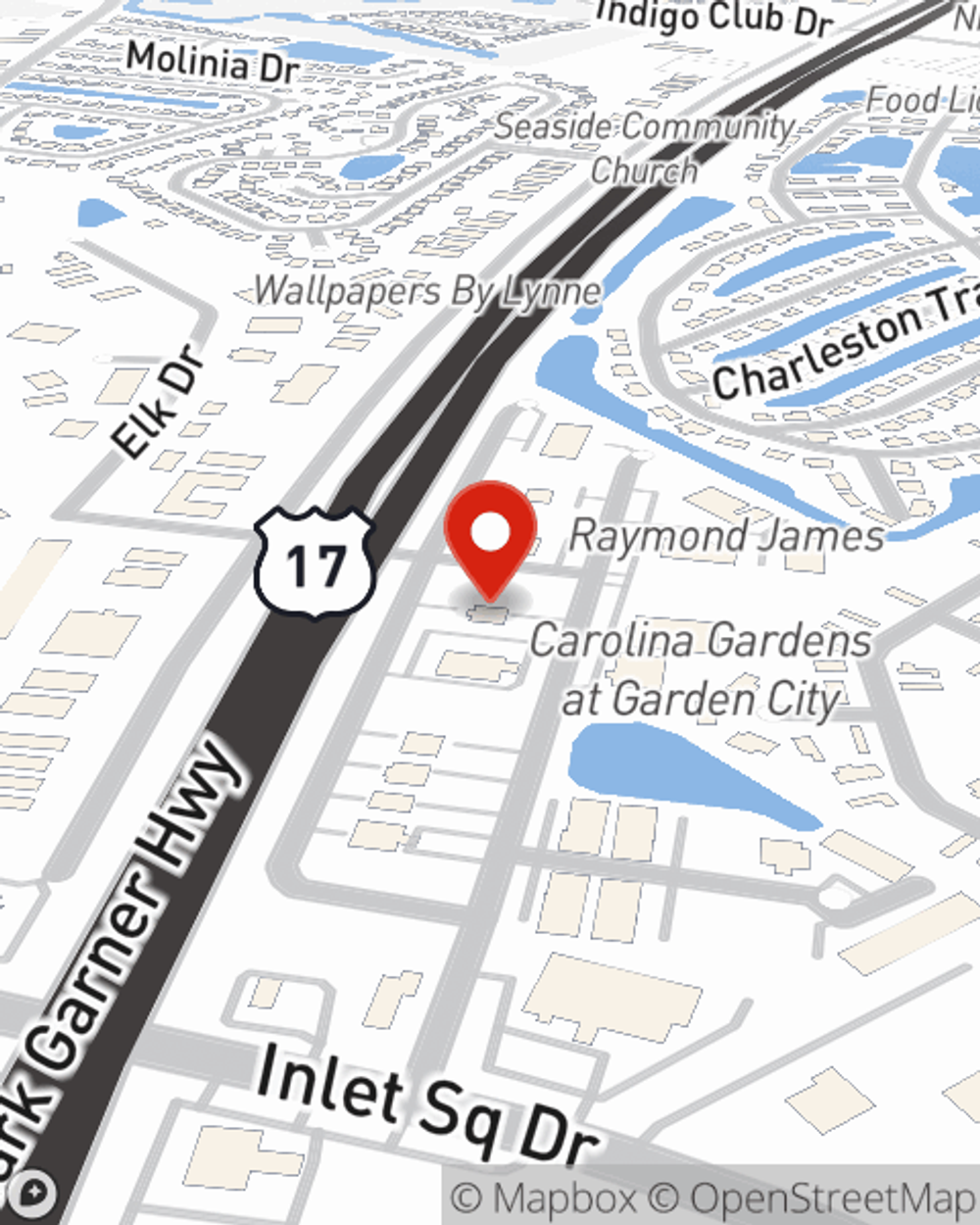

Business Insurance in and around Murrells Inlet

Murrells Inlet! Look no further for small business insurance.

Helping insure small businesses since 1935

Cost Effective Insurance For Your Business.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all on your own. As someone who also runs a business, State Farm agent Tom Leonard understands the work that it takes and would love to help lift some of the burden. This is protection you'll definitely want to learn more about.

Murrells Inlet! Look no further for small business insurance.

Helping insure small businesses since 1935

Small Business Insurance You Can Count On

Whether you are a physician an insurance agent, or you own a meat or seafood market, State Farm may cover you. After all, we've been helping small businesses grow since 1935! State Farm agent Tom Leonard can help you discover coverage that's right for you and your business. Your business policy can cover things such as computers and buildings you own.

When you get a policy through one of the leaders in small business insurance, your small business will thank you. Reach out to State Farm agent Tom Leonard's team today to get started.

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Tom Leonard

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.